| The wages of envy | |||||

|

The Economist, Aug. 20, 1983 The wages of envy

FROM OUR SPECIAL CORRESPONDENT IN SRI LANKA

"The Tamils have dominated the com- manding heights of everything good in Sri Lanka", explained the soft-spoken Cambridge-educated finance minister. Mr Ronnie de Mel is too sophisticated to use the term on the tip of many Singa- lese tongues these days - the need for a "final solution" to the Tamil problem. But, even for him, the "only solution" is to "restore the rights of the Singalese Majority."

Restoring Singalese rights is a code phrase for dislodging the Tamils from their disproportionate influence over large sectors of the Sri Lankan economy. This is what the Singalese mobs set out to do when they put their torches to thousands of carefully targeted Tamil factories and shops. Now the govern- ment is about to advance this process by expropriating all damaged properties. Many Tamils will assist them by leaving the country. The result will be a decisive . shift in the balance of economic power in Sri Lanka from Tamils to Singalese.

The stated aim of the government's takeover of riot-ravaged homes and bus- inesses is to prevent distress sales and to promote an orderly reconstruction pro- granme. Government funds are to be injected into salvageable industries, with export-earners a top priority. In ex- change, the government will take a share of the equity and appoint directors. In theory, former owners will be free to buy back government shares in time. But ministers do not disguise their redis- tributive intentions. Many are talking about following Malaysia's example of writing preferences for the majority into commercial law.

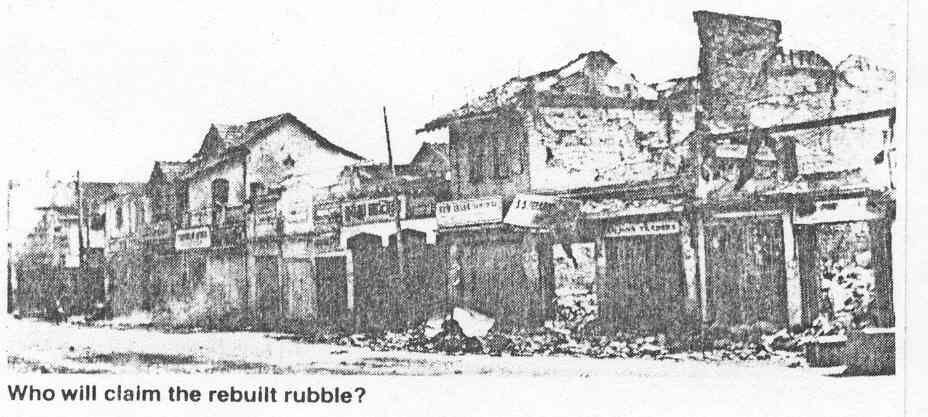

The trade minister has already reor- ganised rice wholesaling to break the Tamil grip. "It is no longer in my interest to allow one community to dominate the wholesale trade in any commodity", insists Mr Lalith Athulath- mudali, who doubles as a government spokesman on Tamil questions. Making room for the Singalese in trade also has a literal meaning. Ravaged city centres such as the Pettah commercial district in Colombo are to be redeveloped; when prime sites are reallocated, former occu- pants will not necessarily get them back. The central bank governor, Mr Rasa- putram, has another justification for taking ownership out of Tamil hands: their companies might otherwise be hos- tage to another wave of communal at- tacks. Better to make Tamil family firms go public and broaden their ownership.

The trouble is that this argument may well frighten off Singalese investors, who have also been shaken by the vision of mob rule. So the main new partners in Tamil-owned companies are bound to be the government and the banks.

|

The state stake in Sri Lanka's injured industries is meant to be temporary. But, if the alternative is returning eco- nomic control to the Tamils, the govern- ment may decide to hold on, The World Bank, among others, is worried that this will mean the expansion of an inefficient state sector; it would prefer to see the financing and management of recon- struction left to the banks. The banks are anyway Involved because of the high level of lending to the ruined compan- ies-how high nobody yet knows.

The loses are still being added up in the statistical department of the central bank, which has sent out teams of ac- countants and surveyors to do an on-site census of destruction, The preliminary estimate of $l50m worth of damage to commercial and residential property - equivalent to about 4% of Sri Lanka's gnp - is almost certainly too low, be- cause it is based on book value; replace- ment costs might be five to 10 times higher. It also excludes the value of lost stocks, lost output and lost export orders.

The destruction of nine coconut mills, for example, could cost Sri Lanka its position as the world's second largest exporter of coconut oil; all oil exports have been suspended. Although half the factories making clothing for export have been put out of action, the net , losses in this $150m-a-year trade may be made up by surplus capacity. Optimistic ministers are predicting that recovery will take two to three years. But this will depend partly on the government's ability to raise capital at home and abroad. The International Monetary Fund is sending a team to Colombo later this month to reassess its agreement to provide $IOOm in three tranches ovcr the next I8 months.

Another key factor in Sri Lanka's recovery will be the brain-drain of Ta- mils. Thousands of Tamil professional people are said to have left the country since the violence last month. One Ieading Tamil entrepreneur - and Sri Lanka's most successful entrepre- neurs are Tamil - estimates that 90% of his fellow-industrialists are now contem- plating emigration. If they go, Sri Lanka will lose more than their capital assets, many of which went up in smoke last month. It will lose commercial instincts and management skills which have aroused Singalese envy but not yet imi- tation. This could prove the most serious casualty of the conflagration of '83. [reformatted from original article] |

||||