From EVs to gorilla glass, the southern state bags marquee investments

by Menaka Doshi, Bloomberg News India Edition Newsletter, October 3, 2024

Employees eat lunch at the mobile phone plant of a Foxconn unit in Sriperumbudur, Tamil Nadu. Photographer: Karen Dias/Bloomberg

This week: The Gujarat model may soon be replaced by Tamil Nadu, an excellent monsoon and Bengaluru’s new neighbor.

Tamil Nadu vs. Vietnam

It’s raining investments in Tamil Nadu, as the state nets close to 1 trillion rupees (approx. $12 billion) in commitments this year. India’s most industrialized state and largest exporter of cars and electronics now competes with not just Gujarat or Maharashtra, but Vietnam and Mexico.

The southern state, home to key Apple manufacturing facilities and maybe soon a Google one, recently bagged projects worth over $350 million from Corning and Jabil that strengthen its electronics component manufacturing value chain.

In January, Vietnam’s VinFast committed to a $500-million phase-one investment to build electric vehicles. Tata Motors just broke ground on a billion-dollar facility to produce Jaguar-Land Rover cars, burnishing the state’s standing among the world’s auto hubs.

Its sweetest success though has been Ford’s decision to return to India, three years after it exited the local market. The US company now intends to restart its factory on prime land in state capital Chennai to make cars for export.

The China Plus One trend is what is driving investments to India and especially to Tamil Nadu, TRB Rajaa, the state’s industries minister, told me. India is producing to global standards, he said, adding that some Japanese investors send their teams to Chennai to study low-defect manufacturing.

The groundbreaking ceremony for Tata Motors-JLR’s new vehicle manufacturing facility in Tamil Nadu.Source: Guidance Tamil Nadu and Tata Motors

The shift in competitive intensity has Rajaa, 48, and his young team consisting of the state’s industries secretary and heads of its investment promotion arms (all in their mid-40s) doing business somewhat differently.

They are analyzing global supply chains for strategic sectors to target key players in the ecosystem, connecting investors to the state’s deep local supplier base, improving port efficiency and offering peer reviews through a buddy system that connects new foreign investors with existing ones to share notes on doing business in Tamil Nadu.

At the state chief minister’s investor roadshow in San Francisco in August, First Solar’s CEO shared his company’s Tamil Nadu experience, serving as the best kind of brand ambassador.

Since Gujarat bagged the two biggest semiconductor projects, Tamil Nadu has set its sights on new investments in compound semiconductors, chip design and life sciences. “Research and development is our strength, we have the highest number of PhDs in India and the highest number of patents registered last year, so we are playing to our knowledge economy,” Rajaa said.

“Investing in India is a bit like shopping for a car,” said Richard Rossow, senior adviser at the Washington-based Center for Strategic and International Studies. In his analogy the central government’s policies represent the exterior, but the states’ infrastructure and policies determine the quality of the ride.

“At the end of the day an investor looking to set up regional production is really looking at Tamil Nadu versus Vietnam a lot of the times, and the state’s approach is critical for those reasons,” said Rossow.

With its Dravidian model of social and economic development, Tamil Nadu has one of the country’s highest state GDP per capita, leads in higher education enrollment and accounts for over 40% of India’s women working in factories.

When it comes to commerce, the state has the largest number of factories (many small and medium sized) and factory jobs, and the best export preparedness, but lags behind Maharashtra and others in foreign investment. Gujarat is ahead in ease of doing business, according to a central government assessment, while Karnataka has the most number of global capability centers.

Tamil Nadu Competes Neck and Neck With Gujarat, Maharashtra

Top 5 states account for over 54% of India’s manufacturing GVA (2022-23)

Rossow says for manufacturing companies, the race narrows to Gujarat for its low cost of logistics, high port efficiency and best power grids, and Tamil Nadu for its educated workforce, deep supplier base and policy incentives targeting sunrise sectors. They’re followed by Maharashtra, Andhra Pradesh and Odisha, for its power reforms.

To stay ahead the southern state needs to sustain the incentives even when governments change, fix its highly indebted and inefficient electricity distribution utilities and improve large-scale availability of medium- and high-skilled manufacturing workers, he added.

While Tamil Nadu has sought to distribute investments and jobs across districts — from Jabil in Tiruchirappalli to Sembcorp in Tuticorin — high absenteeism in some apparel manufacturing units and a month-long strike for higher wages at the Samsung plant underscore the state’s narrowing labor arbitrage opportunity. Last year, unions forced back a proposed law to expand working hours.

In skill-intensive industries, Gujarat and Tamil Nadu have been the traditional leaders but labor-intensive industries are partly “up for grabs,” with Madhya Pradesh, Uttar Pradesh and Odisha making good progress, said Shirish Sankhe, founding partner at the Institute for Sustainability, Employment and Growth Foundation.

Employees wait in line prior to their shift in a mobile phone unit of Foxconn Technology Co., in Sriperumbudur, Tamil Nadu.Photographer: Karen Dias/Bloomber

Already Tamil Nadu’s success at bagging big investments is noteworthy. If the state can generate more jobs even as it moves up the manufacturing and services value chain, then the Gujarat model of doing business in India will have to become the Tamil Nadu one.

By The Numbers: When It Rains…

-

934.8 millimeters

India recorded its best monsoon season since 2020, setting the stage for a bumper harvest of crops such as rice, soybeans and pulses.

Building India: Bengaluru’s New Neighbor

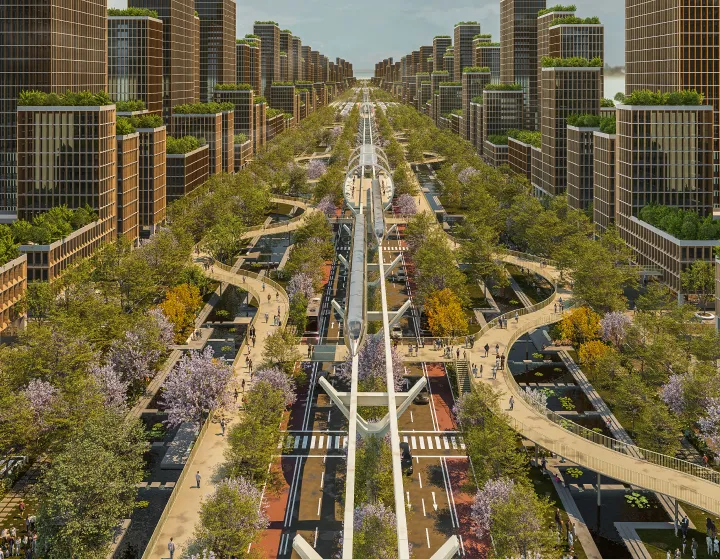

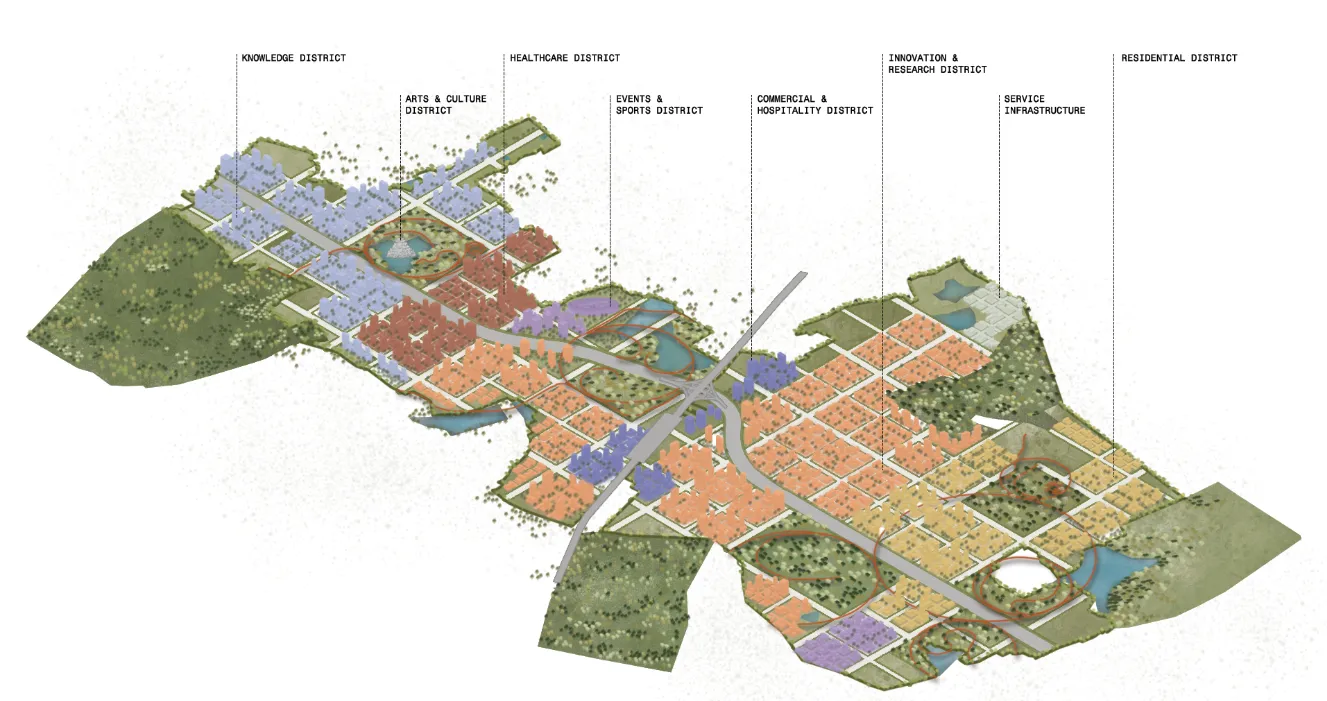

KWIN, a new 5800-acre city in Karnataka, is expected to take the load off the overcrowded tech capital of Bengaluru, where traffic snarls make for viral memes.

Located 50 km from Bengaluru’s city center and within an hour’s distance of Kempegowda International Airport, KWIN will have four districts focused on knowledge, health, innovation and research, according to the city masterplan.

Designed to house 500,000 residents, KWIN aims to be powered entirely by solar energy. The project will cost about 400 billion rupees and is expected to generate about 100,000 jobs, Karnataka’s Industries and Infrastructure Minister MB Patil said at a launch event last week. A construction timeline has not been announced yet.

India has had some success in building planned cities, such as Chandigarh, Navi Mumbai, Bhubaneshwar, Gurgaon and most recently GIFT City.

These long-range, multiauthority projects must survive political changes — Andhra Pradesh’s new capital Amaravati languished when the state’s government changed and is being revived now — and require continued focus on urban planning, as Gurgaon’s recent flooding has shown.

That KWIN’s advisory board has top leaders such as Biocon’s Kiran Mazumdar Shaw and Narayana Health’s Devi Shetty offers hope for the project’s success — though it may never look like this promotional image.